taxing unrealized gains explained

The new proposed tax will be on very very wealthy. I wouldnt call that a wealth tax.

Realized Gain Definition Formula How To Calculate

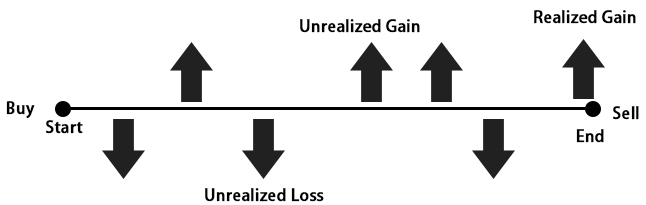

An unrealized gain is a profit that exists on paper resulting from an investment.

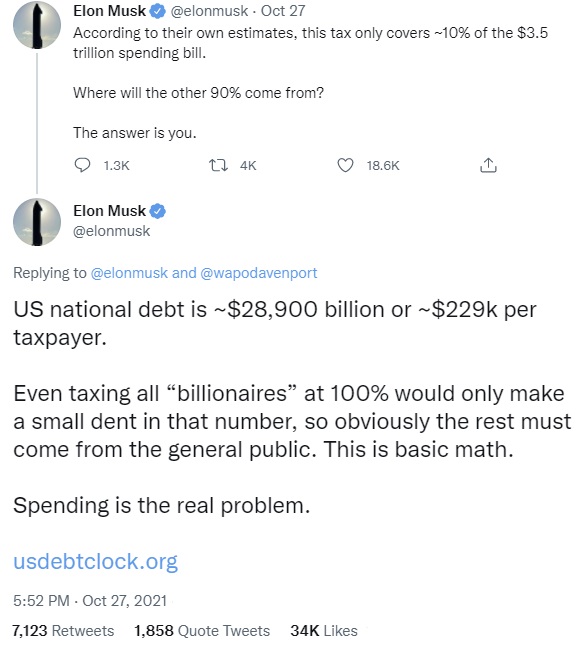

. The madness of taxing unrealized capital gains. Normal capital gains tax only applies once you sell it and realize the gain. President bidens proposal to require roughly 700 us.

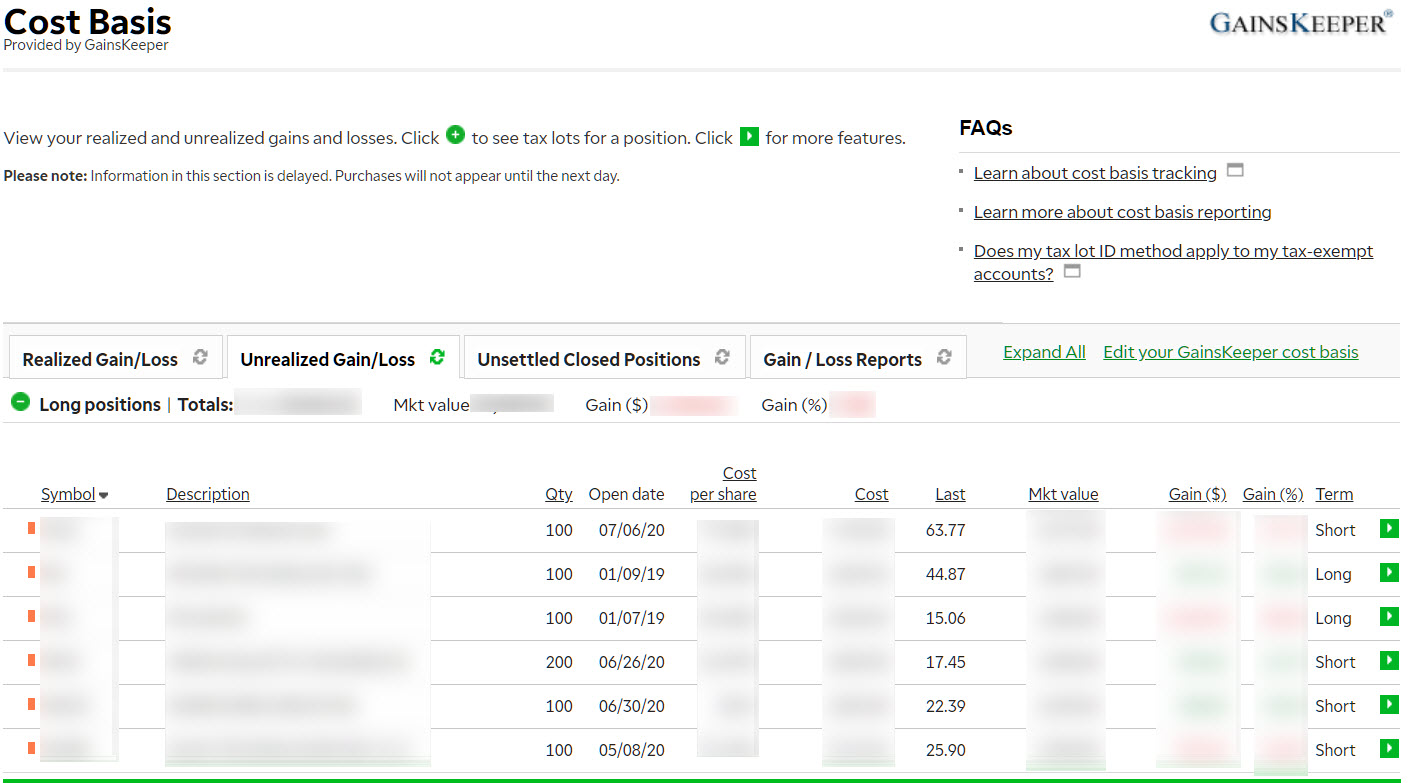

Unrealized PL refers to the estimated profit and loss of an open position also known as floating PL. The third problem is the exemption for unrealized gains on assets that taxpayers leave to their. The only ways to avoid paying capital gains tax are.

Bidens Proposal to Tax Unrealized Gains Upon Death of Asset Owner. The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year. The Problems With an Unrealized Capital Gains Tax.

The unrealized PL displayed in the position tab is calculated based on the last traded. The Institute on Taxation and Economic Policy explained that current tax policy allows the wealthy to defer taxes for years while growing their wealth faster than middle-class. Earn less than 80000 in taxable income if youre married filing jointly less than 40000 for single.

Is a Wealth Tax on Unrealized Capital Gains the Final Straw. Understanding Blockchain and Bitcoin httpsbitly33hbAi5 Subscribe to our channel here so you do not miss our DAILY VIDEOS and pr. Unrealized gains are not taxed until you sell.

It imposes an additional 38 tax on your investment income including your capital gains if your modified adjusted gross income MAGI is greater than. Democrats billionaires tax explained. You buy 05 Bitcoin for 30000.

It is a profitable position that has yet to be sold in return for cash such as. Example of New Proposed Wealth Tax on Unrealized Capital Gains Explained. You have an unrealized gain of 3000.

An unrealized gain refers to the potential profit you could make from selling your investment. An unrealized gain or loss is a capability of a business to have profit or loss on paper which results from an investment. There is now legislative language behind the push to tax American billionaires on unrealized capital gains as Sen.

An unrealized gain is when you have not yet sold the thing. 250000 if married filing. Never sell an asset.

In other words if an asset is projected to make money but you dont cash in on. It is the increase or decrease in the value of the asset that is kept. The price of BTC has increased by 3000 but you havent sold your asset.

An unrealized gain is an increase in your investments value that you have not captured by selling the investment. Taxing unrealized gains explained. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant.

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Here S How Janet Yellen S Proposed Tax On Unrealised Capital Gains May Work Business Insider India

Wyden Details Proposed Tax On Billionaires Unrealized Gains Roll Call

Unrealized Capital Gains Tax Explained

Sweeping Reform Would Tax Capital Gains Like Ordinary Income Itep

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19430294/Screen_Shot_2019_12_04_at_1.44.54_PM.png)

Joe Biden S Tax Plan Explained Vox

A More Constitutional Way To Tax The Rich Planet Money Npr

Biden Plans To Tax Generational Wealth Transfer Through Unrealized Capital Gains At Death Brammer Yeend Cpas

Unrealized Capital Gains Tax For Billionaires Explained

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Janet Yellen S Idea To Tax Unrealized Capital Gains R Wallstreetbets

Crypto Tax Unrealized Gains Explained Koinly

Crypto Tax Unrealized Gains Explained Koinly

Unrealized Gains And Losses Explained Examples

Crypto Tax Unrealized Gains Explained Koinly

What Are Capital Gains Robinhood

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

Elon Musk S Warning About Government Spending And Unrealized Gains Tax Proposal Highlights Benefits Of Bitcoin Economics Bitcoin News

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)