is an inheritance taxable in michigan

What is an Inheritance Tax. Is Your Inheritance Taxable.

Federal And Michigan Estate Tax Amounts On Inheritances

This interview will help you determine for income tax purposes if the cash bank account stock bond or property you inherited is taxable.

. Is Social Security taxable in Michigan. When the beneficiary receives dividends from held shares or capital gains from selling shares. For heirs of individuals who passed after 1993 inheritances from a Michigan estate that includes only property located in Michigan will not be subject to inheritance tax.

Michigan does not have an estate tax or an inheritance tax. But if the estate. Thus the maximum Federal tax rate on gains on the sale of inherited property is15 5 if the gain would otherwise be taxed in the 10 or 15 regular tax brackets.

The tool is designed for. Michigan does not have an inheritance tax with one notable exception. Regarding your question Is inheritance taxable income Generally no you usually dont include your inheritance in your taxable income.

Mom had opted to have federal. Its applied to an estate if the deceased passed. When you inherit an annuity the payments you.

Died on or before September 30 1993. This is a frequently misunderstood question related to taxation and can be complicated. Mom recently passed and left an IRA with me listed as beneficiary.

I will be splitting it with my sisters. In 2021 federal estate tax generally applies to assets over 117. The federal estate tax generally applies to assets over 1206 million in 2022 and 1292 million in 2023.

When the owner begins payments the income he receives is taxed by the Internal Revenue Service IRS at his current tax rate. While the simple answer to the question is your inheritance taxable is yes its more. Only a handful of states still impose inheritance taxes.

How much can you inherit before you are taxed. Inheritance tax is levied by state law on an heirs right to receive property from an estate. Your main concern may be if your inheritance is taxable and how much you can expect to pay.

The short answer is yes an inheritance may be taxable depending on a few factors. The State of Michigan does not. The estate tax is a tax on a persons assets after death.

What is Michigan tax on an inherited IRA. A frequent question is whether inheritances are taxable. What is the inheritance tax in Michigan.

Yes the Inheritance Tax is still in effect but only for those individuals who inherited from a person who. Social Security payments are not taxed in Michigan. There is no federal inheritance tax but there is a federal estate tax.

Your inheritance can actually be taxed in two ways. Inherited stocks themselves are not taxable but taxes may apply in two scenarios. However if the inheritance is considered.

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

What Are The Duties Of An Executor Or Personal Representative In A Will Brmm

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

Michigan Inheritance Laws What You Should Know Smartasset

Living Trust In Michigan 10 Must Knows Before Creating Your Trust

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

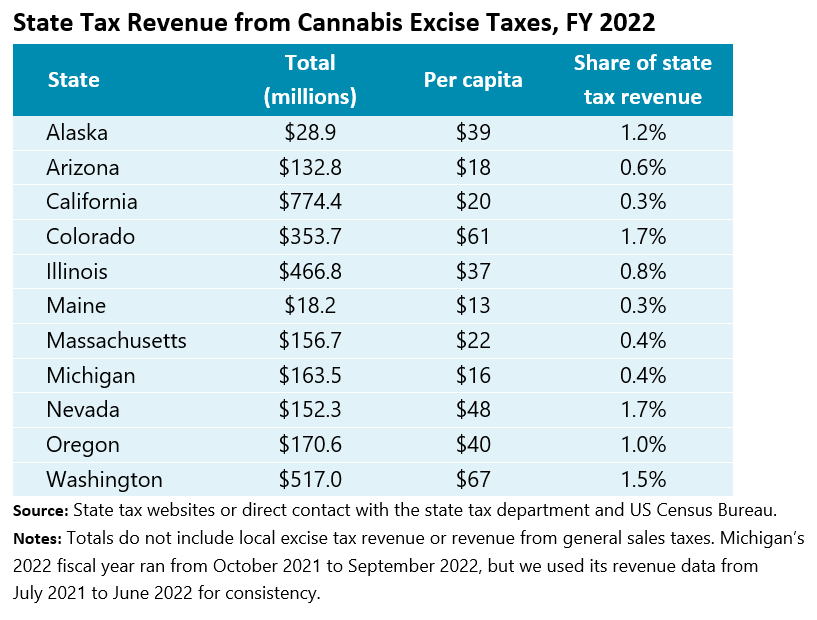

Cannabis Taxes Urban Institute

Do I Need To Hire A Probate Lawyer Michigan Estate Planning

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Federal And Michigan Estate Tax Amounts On Inheritances

Michigan Inheritance Tax Explained Rochester Law Center

Estate Taxes In Michigan Michigan Estate Planning Lawyers

What Taxes Are Associated With An Inheritance Rhoades Mckee

Michigan Inheritance Laws What You Should Know

State Estate And Inheritance Taxes Itep

Estate Planning Michigan Step By Step Guide To Estate Plannings

Clipping From Petoskey News Review Newspapers Com

Estate Planning Attorney Law Offices Of Rl Johnson Pllc

The Descent And Distribution Of Property Of Intestates Under The Laws Of Michigan With Leading Features Of The Inheritance Tax Law Walmart Com